Greece was among the first Mediterranean countries to organize and implement a recovery plan to save national tourism; in addition to proposing the creation of the European health passport, Greece organized the vaccination program to immunize the tourist islands, announced the reopening to summer tourism in advance, opened the borders to vaccinated tourists and launched a campaign to attract “digital nomads”.

Together with Spain, Greece is a destination that is investing heavily in tourism recovery and is being closely watched – especially by its competitors – to see if the market responds to the countries’ efforts.

TREND. During the last thirty days, 3.7 million travelers searched for flights to Greece; when compared to the previous month, flight searches to Greece have increased by 20%, or approximately 628,000 flight searches.

It might still seem like a good amount of growth but, in reality, interest is slowly fading after the boom in searches at the end of February triggered by the announcement of the plan to reopen the border. The trend has remained stable, with average growth of 1.2% daily.

The geographic distribution of searches is very concentrated: travelers are mainly looking for flights to reach Attica (30%) and, in particular, Athens International Airport (29%); the Southern Aegean Region – Cyclades (17%); and the Island of Crete (16%). These three regions represent more than two-thirds of the total searches and are also the ones that have grown the most compared to the previous month. Flights to Attica increased by 177,600 (+18.9%); in the Southern Aegean and Cyclades, by 140,500 (+28.1%); and, in Crete, total searches increased by 110,800 (+22.6%). In Central Macedonia (+83,600) and the Ionian Islands (+46,100), searches also increased.

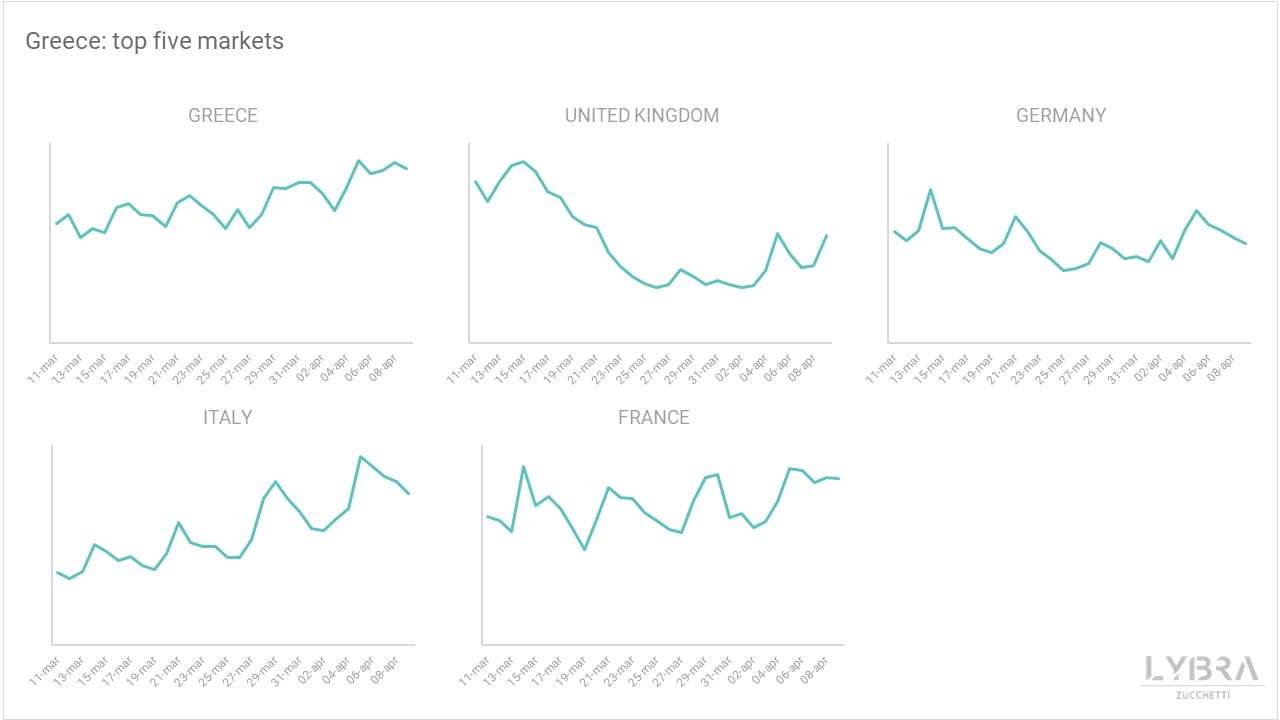

MARKETS. With respect to origins, the main nationality of users searching for flights to Greece are Greek (22%), but the domestic market share is low compared to other countries (i.e. in Italy, it is currently 33%). Other than Greek nationals, the main foreign markets interested in Greece are: United Kingdom (16%), Germany (10%) and Italy (9%); all other nationalities have a weight of less than 10%. That being said, the British and German markets have a negative growth trend, caused by the recent closing policies of their respective countries: travelers from the United Kingdom, in particular, fell by 42% within a week. Among the most active foreign markets is Italy’s, which grows with a daily average of 7,500 searches per day (a growth rate of +3.4%); Italy is followed by the Israeli market, increasing by 2,400 searches per day (a growth rate of +3.8%) and the French market, increasing by 1,300 searches per day (a growth rate of +2.0%).

THE GREEK SUMMER. Currently, 23% of users are looking for flights with departure within the month of April. For the summer months, the most searched period is July, with a request for 646,000 flights (17%). May is in second place with 601,000 flights (16%), followed by August with 530,000 searches (14%), and by June with 475,000 (13%). To date, travelers aren’t very interested in September travel (there were only 236,000 searches – a growth rate of 6%), but this may simply show a lack of confidence in the market, over the long-term.

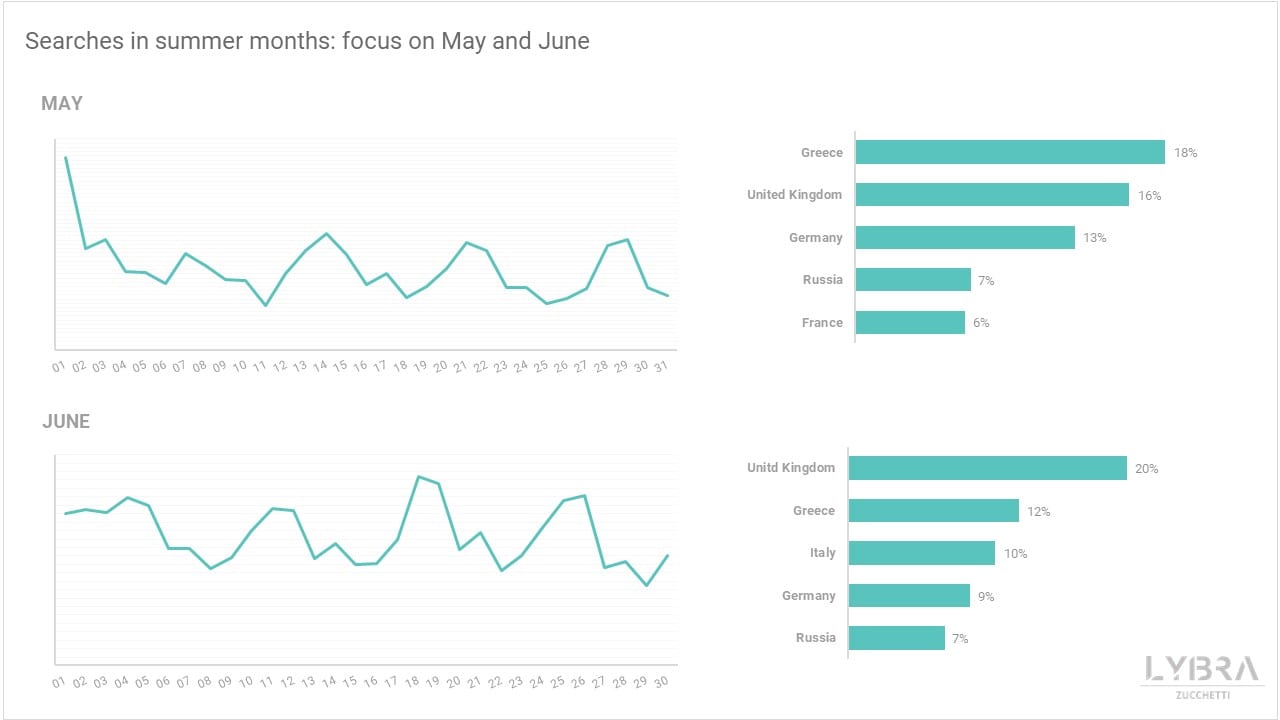

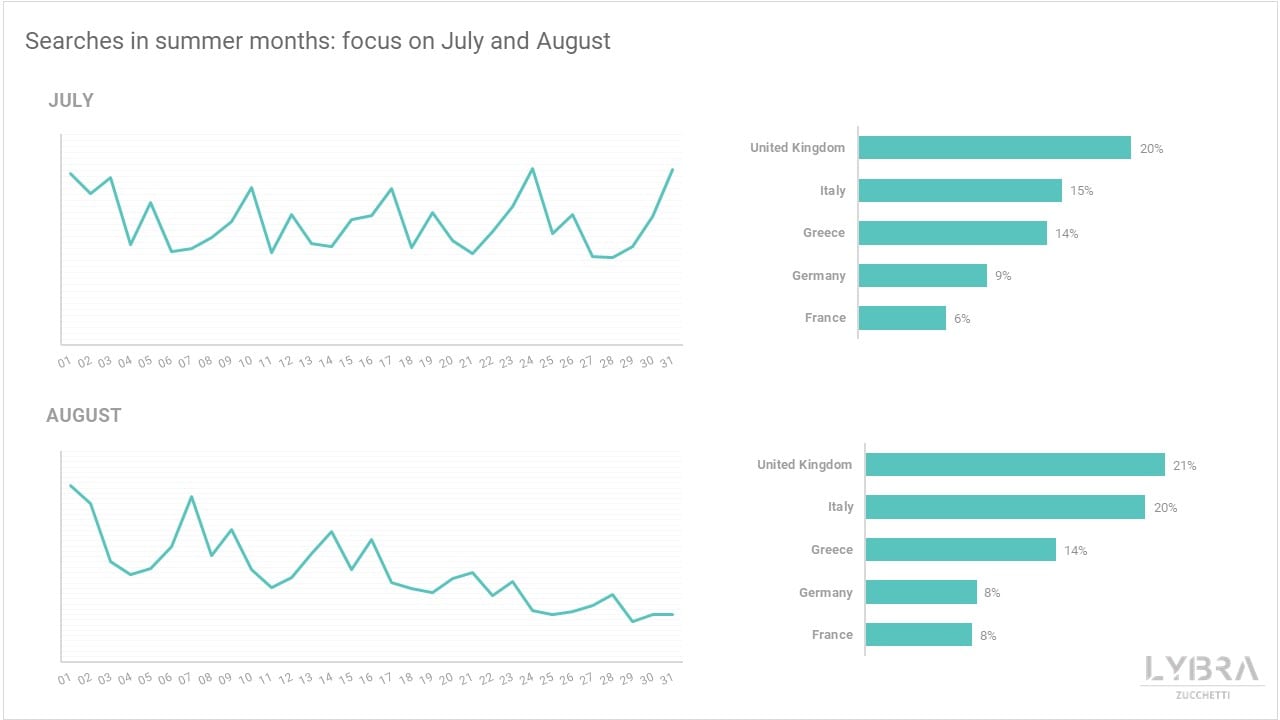

July is the preferred month for the British, Greeks and Germans; Italians and French prefer traveling in August. From the data, it’s clear to see the impact of English policy on the travel market: from June (planned date of re-opening of travel abroad) onwards, users from the United Kingdom represent the first market interested in reaching Greece, with a fixed share of 20-21% of the total interest.

The make-up of travelers changes significantly depending on the month, but the weekend is always preferred for departure dates: in May, domestic travelers are the top (107,000 flights), followed by the British (94,000), the Germans (75,000) and the Russians (40,000). The major searches are for May 1st and for the weekend of May 14th.

For June, the top market is the UK (92,000); followed by the Greeks (57,000), the Italians (49,000) and the Germans (40,000). In June, the most popular period is the third weekend of the month.

For the month of July, the British are looking for 126,000 flights, the Italians are searching for 94,000 and the Greeks are searching for 87,000. The requests are very strong for the weekends, especially for the weekends of the 24th and 31st.

In August, however, interest stops in the first week: no peak for August 15th, but a slow decline towards the month of September. The most interested travelers are, once again, the British (113,000 flights), followed by the Italians (106,000), the Greeks (72,000) and the Germans (42,000).

About Destination

Destination is a market intelligence project created by Lybra – developers of the most complete, machine learning, data-centric Revenue Management System (RMS) available on the market – to share real-time, region-specific statistics, information and trends in the world of tourism.

Every day, Lybra analyzes millions of datasets – data collected from thousands of hotels’ PMS and flight search data from a leading metasearch booking engine – to help hoteliers “look ahead to better understand the present;” in other words, Lybra helps hoteliers understand the upcoming demand for their destination and gives them the revenue management tools and actionable insights necessary, to maximize bookings and revenue.

The aim of Destination is to give hoteliers and DMOs a more expansive view of tourism news and trends in different regions around the world. Destination produces weekly Travel Demand Reports, which share tourism developments for a specific country/region and analyze how the region’s travel news has impacted tourist demand. Follow Destination on LinkedIn to gain access to the upcoming Travel Demand Reports, which are published every Tuesday.